In the whirlwind of Toronto's real estate market, finding a foothold can be daunting, especially for busy professionals like physicians looking to invest wisely. Amidst the cacophony of statistics and forecasts, discerning the signal from the noise is crucial. So, let's embark on a journey through the labyrinth of numbers and narratives, exploring what the Toronto Regional Real Estate Board's (TRREB) 2024 Housing Outlook report reveals for physician real estate investors like us.

Riding the Waves of Market Trends

Picture this: a bustling metropolis, where homes are more than just brick and mortar; they're investments in the city's heartbeat. TRREB's report paints a vivid picture of Toronto's housing market, where sales activity swells and recedes like the tide. In 2023, the market faced headwinds, experiencing a 5.4% decrease in sales compared to the previous year, with average home prices decreasing from $1,190,749. to $1.1 million. Prior to months of consecutive interest rate hikes, the average selling price of a Toronto home peaked at $1,334,062 in February 2022. However, looking ahead, the forecast paints a more optimistic picture. With sales accounting for a greater share of listings in 2024, expect the average selling price to grow by almost four per cent to $1.17 million – the second-highest mark on record but still below the 2022 peak.

But what will drive this growth? The direction of mortgage rates will be the key determinant of housing market conditions in 2024. The expectation is that the Bank of Canada will start to unwind some of its earlier interest rate hikes to ensure a soft landing in the economy in 2024. As mortgage rates adjust, they will influence buyer behavior and affordability, shaping the trajectory of the housing market.

In January, Toronto's real estate market surged due to lower 3-year fixed mortgage rates, falling from 6.5% to nearly 5% in a few weeks. However, robust job and economic growth data for January 2024 indicate a possible delay in Bank of Canada interest rate cuts until summer, potentially slowing down buying momentum and prolonging opportunities for deals in Toronto's current buyer's market.

Neighborhoods: The Pulse of Possibility

In the mosaic of Toronto's neighborhoods, each stroke adds a unique hue to the canvas of real estate investment. Peel back the layers, and you'll find pockets of potential waiting to be uncovered. TRREB's report whispers secrets of appreciation and desirability in certain locales, beckoning investors to delve deeper. For instance, neighborhoods like Leslieville and Junction Triangle have seen remarkable appreciation rates of 12% and 15%, respectively, in the past year, driven by a perfect blend of urban amenities and community charm.

Rental Revelations: A Physician's Prescription for Passive Income

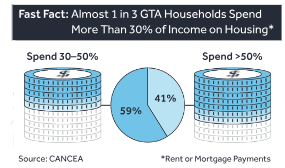

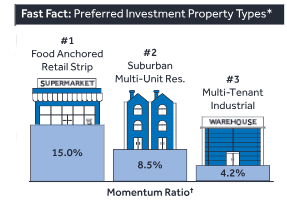

For the astute physician investor, rental properties offer a prescription for passive income. But before diving headfirst into the landlord's domain, heed the insights offered by TRREB's report. Vacancy rates, rental demand, and average rental prices paint a portrait of profitability—or peril. In 2023, Toronto's rental market remained robust, with an average rental rate of $2,500 per month for a one-bedroom apartment—a 6% increase from the previous year and a 9% increase from 2022. As the rental market landscape shifts and evolves, stay nimble, adjusting your strategy to capitalize on emerging trends. GTA households are spending more than 30% of income on housing, as multi-unit residential properties grow.

Adapted from TRREB 2024 Market Outlook & Year in Review